After the pandemic hit, about 25% of the Gen Z population began focusing on financial planning.

25% is better than nothing, but we need to get this number up.

Forming healthy money habits allows you to have greater control over your life and your wallet. Without the discipline of making, saving, and investing your money, you are left to spontaneous, impulse buys, rather than doing what’s in your financial future’s best interest.

If you feel like you don’t have the best grip on your financial habits right now, don’t worry.

In this article, I plan to go over the 3 good money habits I formed that set me up for success going into adulthood.

Let’s jump in.

1. Budgeting my life

According to The Penny Hoarder, 55% of people do not budget! More than half are going through life aimlessly hoping they’ll make ends meet and not overspend.

Whether you want to grow an emergency fund, plan for a vacation or get into investing, a budget can help you.

But before you can decide on a budget that works for you, you need to know where your money is going.

Tracking your expenses

As Darren Hardy says, “All winners are trackers.”

If you want to stay on top of your finances, save for your future, and come out ahead, you have to track your spending.

Expense tracking is where you track and add up every penny that comes out of your bank account. It allows you to have a very clear understanding of where your money goes and how responsible you are with it.

Having this newfound awareness is the first step to developing healthy, money habits.

How to track your spending

- Pen and paper. I’m old-fashioned and use a simple pen and notebook that never leaves my side. Whenever even a penny leaves my bank account, I write it down. At the end of the week, I add up my expenses to see where I stand. Sometimes I feel proud. Other times, I wish I hadn’t even looked. Nonetheless, it’s eye-opening. And eye-opening is what you need to get on track.

- Keep your receipts. Collect all your receipts from your purchases over the last week or month (if you keep them that long) and add them up based on their categories. This will show you how much you spend regularly in each category.

- Go through your statement. If you’ve thrown away all your receipts, consider printing off one or two months’ worth of bank statements. This will break down exactly where that dollar’s been going.

Once you have a clear understanding of how much you spend in each category, you can work on developing your budget.

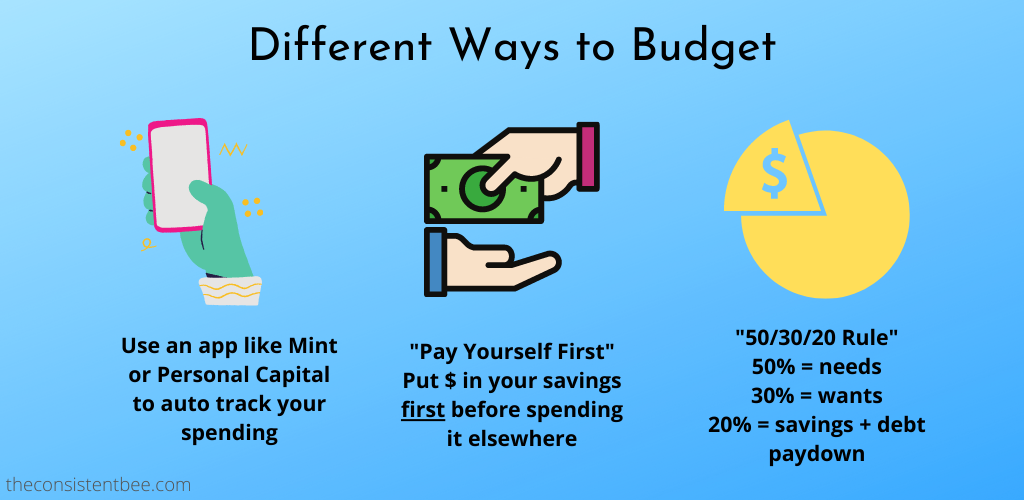

Different methods of budgeting

- Use an App. Apps like Mint and Personal Capital are great tools for tracking your expenses and setting up a budget for yourself. If you’re more tech-savvy and prefer to have everything on your phone, this may be a great option for you.

- “Pay yourself first” budget. With this type of budget, you prioritize saving and paying down debt. You allocate a certain amount each month to go into your savings and then to pay down the debt you owe. The rest can be spent how you see fit. Make sure those bills are covered though!

- 50/30/20 budget. This budget states that 50% of your income goes to “needs,” 30% goes to “wants” and 20% goes to savings and debt paydown. This is just a rule of thumb however, so adjust the numbers based on your unique situation.

2. Paying myself first

One good habit I got into at a young age was paying myself first.

Meaning, from every paycheck I would set aside a certain amount and put it in my savings account before even touching my bills or eating out with my friends. Paying yourself first allows you to always be saving, and that’s what matters.

Utilize automatic transfers

Consider setting up an automatic transfer to go from your checking account to your savings account after each paycheck.

A good rule of thumb to follow is setting aside 20% of your income for savings.

So if each paycheck is $1000 every two weeks, you would set aside $200.

If setting aside 20% of your income gives you anxiety, start lower, at like 10% or 5%. You could even start by saving just $1 per month.

It may not seem like it’ll make a dent but it’s one more dollar in the savings account than before! And if you can find a high yield savings account to store your money in, compound interest will help you the rest of the way.

As of the time of this writing, interest rates aren’t too high, but have a look around at online savings accounts and see if you can find one that suits you.

3. Investing in index funds

Another habit I adopted in my early twenties was investing regularly in an index fund.

What’s an index fund?

In formal terms, it is “a type of mutual fund or exchange-traded fund (ETF) with a portfolio constructed to match or track the components of a financial market index, such as the Standard & Poor’s 500 Index (S&P 500).”

In layman’s terms, you can think of it as a basket of hundreds of stocks. Your money is divided among those many stocks, so if one company doesn’t do too well, you have hundreds of others to balance your portfolio out.

That’s why index fund investing is so low risk.

I got started in March 2020, right when the pandemic was on the rise and the market was at an all-time low. Since then I’ve been contributing to my index fund monthly and have seen a 37.8% return. Not too shabby!

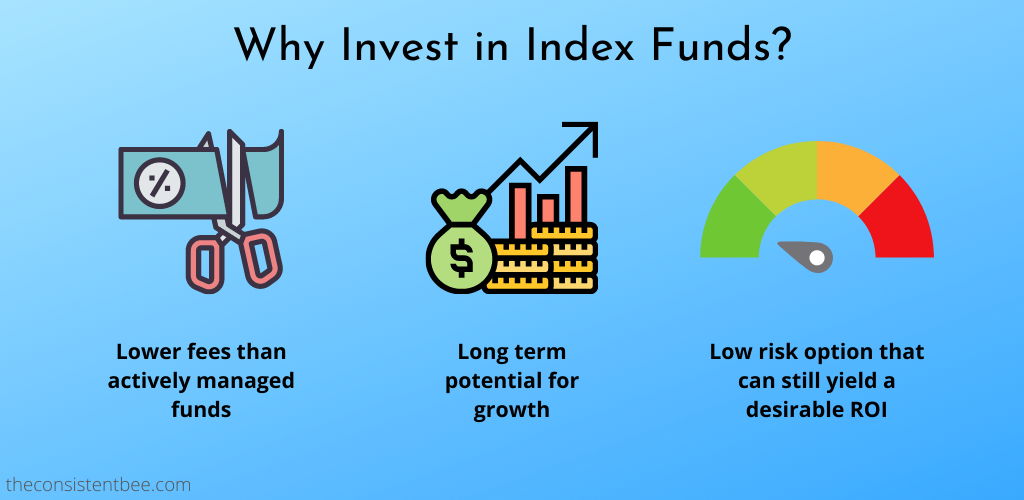

Benefits of investing in an index fund

- Lower fees. Index funds charge lower fees because they don’t have to be actively managed by a fund manager.

- Long-term potential for growth. Index funds are long-term investments. If you invest in an index fund that tracks the S&P 500, an index that has an average annual return of 10%, your money is sure to grow in the long run.

How to invest in an index fund

- First, decide on your investment goals. If you are in your twenties, you have a while before retirement rolls around. This means you can withstand more risk and roll with the punches as the market ebbs and flows. You may want to invest in riskier investments with a greater return like equity index funds, for example. If you’re nearing retirement age though, you may want to consider something less risky, like bond-based index funds.

- Do your research. Research different index funds, their performance, and expense ratios before investing in any of them.

- Open an investment account. Some options are retirement accounts like IRAs, ROTH IRAs, or 401ks. Other options include brokerage accounts and education savings accounts, like a 529 plan. Always find out if your investment account charges fees, so you’re not left in dark. I personally use a brokerage account through Vanguard and it is serving me well.

- Purchase your first index fund. The most exciting part! There are lots to choose from, so like I said, do your research before investing. Be sure to check if there are any fund minimums and be sure to meet that minimum. For example, when I invested in the Vanguard Total Stock Market Index fund or VTSAX, it had a fund minimum of $3000. My partner and I had to pool our money together to begin investing in this fund. So be mindful of any minimums you may have to meet.

- Set up recurring contributions. The most important part! Now that you’ve got your investment account opened and have invested in your first index fund, it’s time to set up recurring investments. For most people, investing in an index fund isn’t a one-and-done kind of thing. By contributing to the fund regularly (monthly, for example), you make sure to keep yourself on track to hit your retirement goals. It also removes the headache of trying to “time the market.”

Conclusion

If I hadn’t have developed these money management habits, I wouldn’t be as far along as I am today. No matter what age you are though, it’s important to develop good money habits so you can be in control of your wallet and your future.

Not sure where your money is going? Track your expenses.

Start a budget to keep your money in line and ensure you have money to put aside for your savings account.

Set up automatic transfers so a certain amount from your paycheck goes to your savings account, without even having to think about it. You can start small like $10 every two weeks and then work your way up from there until you hit your savings goals.

Finally, once you have at least an emergency fund set up, you’ll want to look into investing. There are many options when it comes to investing but I’ve found index funds to be an easy, low-risk way to get started.

Don’t be too hard on yourself if it takes you some time to form these habits.

Rome wasn’t built in a day, as they say. As long as you commit to doing just 1% better each week, you’ll be well on your way to building a very bright financial future.

One Response

Thx.